The following statements are provided solely for general informational purposes and relate only to general considerations. The content has not been prepared for any particular financial situation or the specific needs of any investor, and it does not constitute investment advice or an offer. For more information, please see our Terms of use.

There are many ways to protect a stock portfolio from losses during a bear market.

The simplest option would be to sell all positions. However, depending on the size of the portfolio this entails high transaction costs and is not very practical, because the positions will have to be rebuilt if one wants to continue participating in the market at a later date, which in turn generates additional transaction costs. Beyond the costs, there are other reasons why investors prefer to hedge their portfolio—or individual equity positions—against price declines rather than sell them: for example, investors may wish to keep exercising their voting rights and not forgo dividend income.

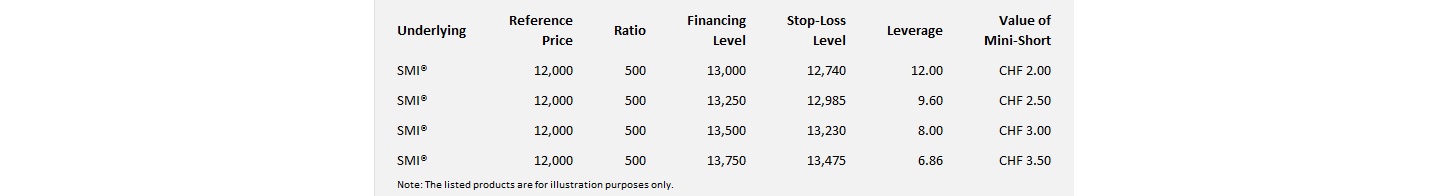

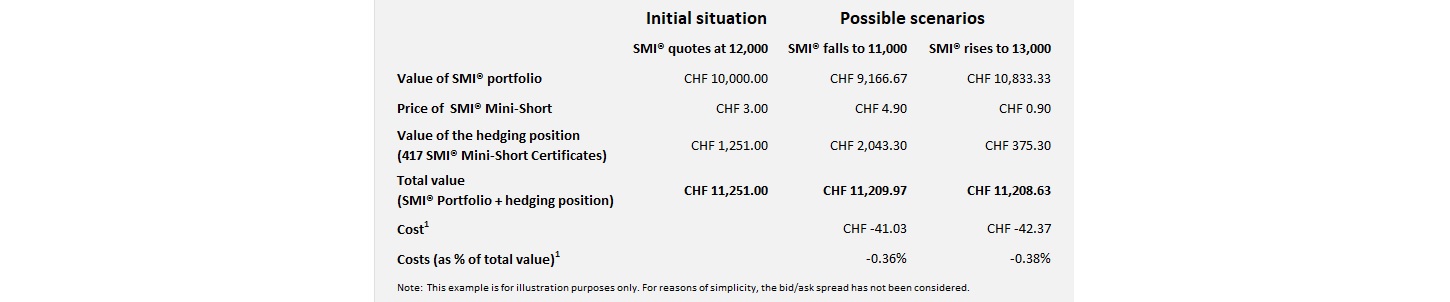

The following example shows how a portfolio of Swiss equities valued at CHF 10,000 can be hedged against falling prices. An analysis of the portfolio’s stocks indicates that it should track the Swiss Market Index SMI® (hereafter "SMI") closely, so the portfolio can be hedged with SMI Mini-Futures or SMI Knock-Out Warrants. However, hedging can only be performed approximately, because it entails costs and the correlation between the portfolio and the index is rarely 100 % in practice.

For the sake of simplicity, we will limit the example to portfolio hedging with SMI Mini‑Shorts. However, the same method can also be applied 1 : 1 to hedge with SMI Knock‑Out Puts.